It goes without saying that the Federal Reserve’s monetary policy has been extraordinarily loose since the financial crises of 2008. The Fed has had a zero interest rate policy (ZIRP) for 7 years now, not to mention its 3 rounds of quantitative easing (QE). The Fed’s balance sheet has grown over this time period from approximately $800 billion to $4.5 trillion. And even if the Fed raises rates 0.25% as it is expected to do in December 2015, it will be years (or perhaps generations) before we see anything like normal monetary policy.

There are many, many reasons to criticize the money printing policies of the Federal Reserve (and all the other central banks of the world). They blow serial asset bubbles. They create moral hazard. They favor borrowers over savers. They cause future inflation. They bail out undeserved banks. They create “too big to fail” conditions. They encourage risky investment and speculation. They contribute to income inequality.

Even supporters of easy monetary policy, a group to whom nearly all mainstream economists and politicians belong, will admit to some, if certainly not all of these risks. But, they would argue that these risks are worth it. Worth it to help the economy recover from financial crises. More specifically, worth it to help employment.

As you might know, when it comes to monetary policy, the Federal Reserve has two congressionally mandated goals. One is stable prices. The other is maximum employment. Since inflation, at least as measured by the Consumer Price Index (CPI), has been quite benign, the Fed has felt compelled, or at least free, to focus on helping employment. Hence the policy of low interest rates and printing money.

Related post: Why does loose monetary policy help employment (the mainstream argument)?

Low interest rates and printing money should lead to more borrowing, more consumption, more investment and more jobs. But, and this is a big BUT, what if that’s not what happens? Put simply, what if the Fed’s policy of easy money is actually destroying jobs, not creating them? That’s what I think is happening. Let me explain why.

The Subsidy to Growth

First, recall one of the most fundamental principles of finance: the value of any asset, such as a company or its stock, is inversely related to its cost of capital. In other words, the cheaper a company can access money, the higher its valuation. Since interest rates are the primary driver of a company’s cost of capital, the Fed’s loose monetary policy acts as an enormous subsidy to all companies and all asset classes.

But, the Fed’s valuation subsidy does not impact all companies equally. By suppressing interest rates the Fed has encouraged and even forced investors to take on incrementally more risk. Or in technical parlance, risk premia have been compressed. The higher the risk of the investment, the more that the risk premium has been reduced, and the greater the increase in asset value. So while all assets have received a valuation “subsidy” due to easy monetary policy, high risk companies have received a proportionally larger one.

You may be thinking, how can the Fed “force” investors to take on risk. We live in a free country. Nobody is forced to invest in risky assets, right? Not exactly. Consider an insurance company or pension fund that has future liabilities that it must fund. If the insurer or pension fund cannot meet its necessary investment return from safer assets then it has no choice but to take on more risk. The same concept holds for any investor that requires investment income, either now or sometime in the future. Need a 6% return but very safe assets pay nothing? Take on more risk.

In fact, risk premia are compressed not only by artificially low interest rates. They are suppressed even further by another central banking policy, known as the “Greenspan put.” Simply put (no pun intended), the Federal Reserve has made it very clear, since at least the stock market crash of 1987, that it will provide liquidity to support asset prices in the event of market “dislocation.” Hence, with the implicit promise of a bailout, risk premia are even lower and valuations even higher.

By encouraging risk and suppressing risk premia, the Fed has subsidized high risk companies. Who are these high risk companies? More than anything else, these are high growth tech companies. We see this subsidy through the high public valuations and trading multiples of the Facebooks, Twitters and Amazons of the world. We see it through the private valuations of the “unicorns” such as Uber, Airbnb and Dropbox. And we see it through the basic business model of venture capital where a higher and higher valuation for a winning investment can support more and more losing ones.¹

Creative Destruction or Subsidized Disruption?

Why is it a problem that the Federal Reserve is subsidizing high growth, high risk companies at the expense of lower growth, lower risk companies? Isn’t that a good thing and isn’t that exactly what the Fed should be doing to help grow jobs?

Unfortunately, the answer is no. High growth/high risk companies, as best exemplified by the tech industry are not adding to overall U.S. employment. In fact, in today’s world, high growth companies are typically net destroyers of jobs, not creators. To use the trendy term, tech companies are “disrupting” traditional employers.

There is no better example than the internet retailer, Amazon. Amazon is great (at least in the near-term) for consumers. You can shop in your pajamas, pay rock bottom prices and get fast, free delivery. And certainly, Amazon’s stock performance has been great for its investors and its management. But has Amazon’s enormous growth really benefited the U.S. economy? In terms of employment, the answer is clearly no.

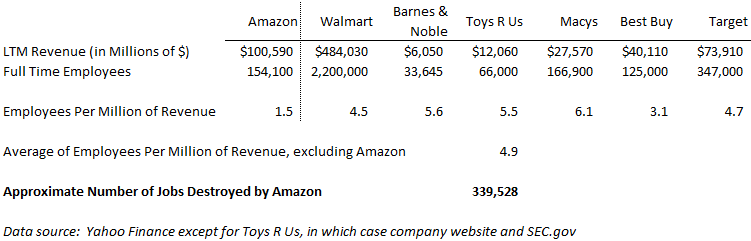

As you can see in the table below, Amazon had about $100 billion of revenue over the past twelve months and accomplished that with approximately 154,000 employees. So in one sense Amazon created 154,000 jobs, or about 1.5 jobs for each $1 million of revenue.

Sounds like that’s great for the economy, right? But that’s not the whole story. For the most part, Amazon’s revenues come at the expense of traditional retailers. So the question to ask is how many people would traditional brick-and-mortar retailers have employed if they, and not Amazon had generated those revenues.

Again, looking at the following table, we can see that Amazon’s competitors, such as Walmart, Barnes & Noble and Toys R Us employ far more people for each dollar of revenue. A simple average of this metric for 6 traditional retailers indicates about 4.9 employees per $1 million of revenue, far higher than Amazon’s 1.5. And this figure is probably understated since smaller privately held retailers probably have even more employees per dollar of revenue.

So for each $1 million of Amazon’s revenue, around 3.4 jobs in the U.S. economy are lost or never created. Based on its most recent twelve months of revenue, Amazon is directly responsible for the destruction of more than 300,000 jobs.

Now you may be thinking, doesn’t this sound like capitalism at work, like creative destruction? Old companies and old technologies being replaced by new companies and new technologies? The automobile replacing the horse and buggy? The digital replacing the analog?

In a proper world with normalized interest rates, you would be correct. Investors would make discriminating decisions on where to invest their money based on a company’s business model, its projected profitability and cash flows, and its perceived risks. Let the company with the better product or the more efficient operations win, and if that company happens to be more productive and employ fewer people, so be it.

But thanks to the Federal Reserve, we don’t live in such a world. We live in a world where the cost of capital especially for high growth companies is much, much lower than it should be. This is a world where companies are too easy to start and money is too easy to raise. A world where growth trumps profitability and where not even a plan for revenue, let alone actual revenue is a prerequisite for an IPO or a multi-billion dollar valuation.

This is a world where established companies with real business models and real profits are “disrupted” by an endless wave of companies, large and small, with full bank accounts and empty business models. Facing this subsidized onslaught, good companies, those that are profitable (or would otherwise be), forego hiring or worse, are forced to shrink or go out of business.

Amazon, with about 20 years of operating experience, has yet to show that it can be consistently profitable. Given the total absence of barriers to entry in Internet retail, it likely never will. Absent easy money, Amazon would probably not exist, and certainly would not be the disruptive retailing giant that it is.

But this phenomenon of Fed-subsidized job destruction is not limited to the retail sector. It is happening in nearly all sectors of the economy.

Profitless companies like Twitter and Pinterest along with a near infinite number of money-losing Internet content providers have decimated the journalism and print media industries with their free content to the tune of significant job loss.

So-called “sharing economy” startups like Airbnb, a company with a $25 billion valuation and a business model based substantially on flouting local occupancy laws is doing its Fed-subsidized best to disrupt traditional hotel companies such as Starwood and Hilton, companies that employ hundreds of thousands.

Stock market darling but profit-challenged Netflix, a company with about 2000 employees, having put video retailer Blockbuster (60,000 jobs) out of business some time ago now has its well-funded sights set on disrupting the TV and Cable industries.

These are just a few prominent examples of Internet companies that probably shouldn’t exist, fueled by cheap money, eliminating American jobs.

Conclusion

Traditional critics of the Federal Reserve’s extraordinarily loose monetary policy cite the blowing of serial asset bubbles, potential future inflation and “moral hazard” as cautionary tales. But as we’ve seen, the Fed’s actions have a much more direct and immediate effect on the economy. Current monetary policy is hollowing out the economy by subsidizing companies that destroy jobs, to the benefit of a few fortunate investors and entrepreneurs, and to the detriment of many working Americans.

Monetary policy is also an example of the failure of mainstream economics. That is, the failure of mainstream economic models to reflect the complexities of the real world. Textbook models assume that printing money encourages risk taking. This is correct. They further assume that risk taking will lead to investment and job creation. This is also correct. But they fail to realize that much of this new investment competes with established businesses and many of these new jobs come at the expense of a substantially higher number of existing ones.

To be fair, normalizing monetary policy will be a very painful process. In the short-term, many startups and even large tech companies will fail. Asset prices, including real estate and the stock market will decline. It is highly likely that the economy will fall into a recession. Politically this is very hard to stomach. But stomach it we must if we ever want to return to a vibrant economy with real and sustainable job growth.

¹ Assume a venture capital firm requires a 20% annual rate of return (IRR) and invests $1 million per company. Further assume that after 5 years time, the VC firm can exit one successful investment and all the other investments fail with zero return. If the successful exit has a valuation of $25 million, the VC can fund approximately 10 total investments. If the exit has a $100 million valuation, the VC can fund about 40 investments. If the exit is valued at $1 billion, then the VC can afford to fund more than 400 investments.