Here’s another post inspired by the Trump election. What the hell is going on in the world? Why are people so angry? Why are the Brexits and the Trumps of the world winning elections? Why are extremists of the right-wing and the left wing, the populists, the isolationists, the politicians of anti-immigrant and anti-trade persuasion, the fascists and the socialists gaining power all across the western world?

It feels like in recent years that the world has taken a big step backwards. The short-lived optimism brought upon by the end of the cold war has been replaced by fears of global terrorism and the anxiety brought upon by power-hungry dictators and empowered rivals such as Russia and China. Meanwhile, belief in a prosperous “age of moderation” was shattered by the global financial crises and by the indisputable evidence of surging income inequality.

Many smart people have tried to explain the various factors causing our world-wide angst. Capitalism. Wall Street. Globalization. Trade. Technology. Immigration. Terrorism. Some get parts of it right. Some get none of it right. But few correctly see the larger picture, that is, the fundamental trends underpinning these trying times. We can do better.

I believe that the world is experiencing forces brought upon by a combination of two global trends: 1) massive financialization brought upon by short-sighted monetary policy, and 2) the growth of big government and its evil-twin, crony capitalism. Together (and they do go together), these two decades-long trends have depressed productivity and economic growth, subsidized job loss due to technological disruption and excess international trade, and sown the seeds for global terrorism.

No institutions have done more damage to the global economy over the past several decades than the world’s central banks. No idea has done more damage to the global economy over the past several decades than the belief that a centralized government agency can, and should, dictate the economy’s interest rates. Led by the U.S.’s Federal Reserve, this monetary policy experiment has lead to a world in which money is in massive over-supply, risk is massively under-priced and the financial sector has grown to become a massive drain on productivity.

Low interest rates are supposed to encourage investment. Financial bailouts are supposed to prevent disastrous depressions. Perhaps a short-period of monetary stimulus and a once in a blue-moon bailout might not do too much economic damage. But 30+ years of easy money and near-continuous bailouts of banks and the financial system have created such economic distortions that to categorize the U.S. economy as anything near a free market would be utterly wrong.

Of course, Wall Street is not the only entity in town that has grown substantially larger. Growth of federal governments has been almost as devastating to global economies. Marx thought that it was capitalism that was unstable and would inevitably collapse. He was wrong. Regrettably, it is democratic government that seems ultimately unstable and prone to collapse by slowly, but inevitably strangling the economy.

Democracy’s fundamental flaw is that it is biased towards its own growth. Growth of the government workforce, growth of regulation, growth of taxes, growth of disincentives, growth of monopoly. The flip side? Lack of productivity, lack of efficiency, lack of employment, lack of competitiveness, lack of growth, lack of freedom. What began as more or less a free market, becomes, through the growth of government and the cradle-to-grave welfare state, a system of crony capitalism, less and less distinguishable from socialism.

Decades of easy monetary policy combined with the growth of big government have, among other things:

- Encouraged speculation and short-term financial results at the expense of long-term productive investment in infrastructure, research and development and human capital.

- Subsidized consumption at the expense of savings, fostering a culture of indebtedness and instant gratification and exacerbating worldwide trade imbalances.

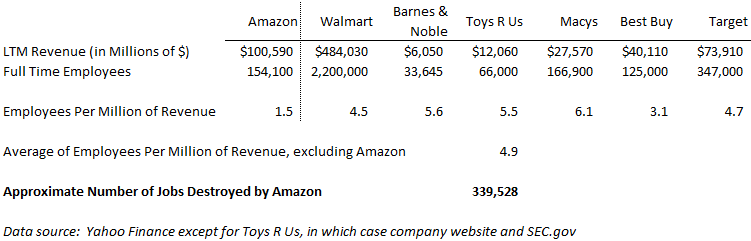

- Subsidized investment in vastly unproductive uses, creating serial asset bubbles in the process. Nowhere is this more evident than in the technology industry where money losing companies funded with massive amounts of inexpensive capital that employ few disrupt profitable companies that employ many. This is not creative destruction, as some would claim. This is subsidized economic suicide.

- Subsidized large, publicly traded and monopolistic companies at the expense of small, privately-held and entrepreneurial companies because of easy access to capital markets, crony capitalism and an emphasis on financial engineering, M&A and private equity activity.

- Caused enormous inflation in non-tradable goods such as healthcare, higher education and real estate. Is it any wonder why the middle class is drowning in debt? Is it surprising that young people can’t afford to pay for college, can’t afford healthcare and can’t afford to buy a house?

- Destroyed the centuries-old business model of local, relationship-based banking and is in the process of destroying pensions, retirement savings and the insurance industry. Collectively, these are the cornerstones of a capitalist economy.

- Directly enriched the wealthy by funneling money through and to Wall Street and inflating financial assets, creating an enormous bifurcation of “haves” and “have-nots.”

- Encouraged an entire generation of the best and brightest to become investment bankers, traders, venture capitalists and consultants, rather than scientists, engineers, doctors, and teachers.

- Allowed governments (the U.S. in particular) to finance naive, adventurous wars in the middle east without the sacrifice of higher taxes, and thus without sufficient contemplation from the citizenry. Further, easy money and big government has subsidized a military-industrial complex lobbying for arms sales, arms subsidies, arms grants and general armament of questionable groups, not to mention all sorts of military involvement and war. Needless to say, the predictable result has been anarchy, terrorism (often, facilitated with our own weapons), untold number of deaths, and the largest migrant crises since World War II.

- Fueled a worldwide energy and commodities boom that enabled petro-dollar dictators like Vladimir Putin and Hugo Chavez to stay in power, and countries like Iran and Saudi Arabia to sponsor and finance global terrorism and religious extremism.

- Subsidized internet and communications technologies that have led to a less-informed global citizenry, the decimation of more-or-less non-partisan media coverage in favor of the consumption and belief in “fake news” and conspiracy theories, as well as aiding in the planning and recruitment of terrorists. Oh, and few if any productivity increases.

- Destroyed entire manufacturing sectors because of regulation, tax policies, protected unionism, and the short-sighted policies of refusing to allow wages to fall. The result being outsourcing, offshoring and global trade far beyond what would likely occur under a true global free market, and significant unemployment.

- Completely divorced the healthcare industry from competitive forces, resulting in the worst of all worlds, the privatization of profits and the socialization of costs (just as the government did with the financial services industries). The inevitable results being skyrocketing healthcare costs, a less healthy populace and monopolization within the entire healthcare vertical.

- Created a bloated, wasteful and monopolistic education system that favors teachers, administrators and bureaucrats at the expense of students. The result of which is an education system that neither produces the “good citizens” necessary for democratic government nor the job skills necessary for a competitive economy.

- Fostered a culture of dependency, blame, over-sensitivity and selfishness rather than self sufficiency, responsibility and community.

The ramifications of poor economic growth and the slow-motion implosion of the welfare state

The upshot of decades of absurd and counterproductive monetary policy and an ever-growing government? Economies especially prone to speculative bubbles and financial crises. Economic growth and productivity far below potential. A bleeding and resentful middle class. Easily financed and poorly planned wars with the terror and chaos that follows. And income inequality the likes of which the world has probably not experienced since before industrialization.

But it gets worse. Combine poor economic performance with the enormous welfare state and you get a downward spiral difficult, perhaps impossible to break.

First and foremost, poor economies hurt those at the bottom of the food chain, most notably young people. With job prospects few or nonexistent, young people delay or completely avoid forming households and having children. You wind up with an aging population with fewer and fewer workers paying into the ponzi-like welfare system and ever greater number of aging retirees taking money out. This is playing out all over Western Europe, but even more obviously in Japan, a country in its third decade of economic depression. (It is mainstream economics to blame Japan’s weak economy on its demographic challenges and aging population. However, this gets cause and effect exactly wrong. It is Japan’s weak economy and poor job prospects that causes its demographic challenges and aging population.)

Further, what happens when masses of unemployed and underemployed young people with poor prospects and little hope are further and further removed from productive society? They turn to drugs (witness the opiate epidemic in the U.S.), crime, and in some cases terrorism.

Moreover, a stagnant or shrinking economic pie causes everyone within society to take a zero sum mentality. That is, whatever government benefits you get, means less that I get. The result is a bifurcation of the populace into two groups: those within the system that are currently benefiting from the crony capitalist welfare state, and those outside it trying to get in. Most notably, who’s in the “out” group? The young and the immigrants. Naturally, this bifurcation leads to resentment and anti-immigration bias. It leads to a two-tiered society. It leads to an unassimiliated underclass, as has occurred in many Western European countries.

So now you’ve got a slow death cycle. The economy is weak and jobs are scarce. The young are unemployed. Immigrants are shunned. The population ages and more and more money flows to entitlements, to pensions, to retirees, to healthcare. Meanwhile local services, education, infrastructure and other forms of investment are cut. More money to unproductive uses, less money to productive uses. So the economy becomes even weaker, and the cycle continues. Yet the elite blame capitalism and ask for even more government. Sooner or later, crises ensues. Pensions can’t be paid. Local governments go bankrupt. Then state governments. Then federal governments. The implosion of the welfare state. It is occurring in Western Europe. Though less apparent and more slowly, it is occurring in the United States too.

The way forward: optimism or pessimism?

As I’ve mentioned several times, the twin maladies of easy money and big government have led to a stagnating world economy, financial bubbles in nearly every asset class, excesses of trade and technology, unprecedented income inequality, global terrorism and anti-immigrant and anti-trade sentiment throughout the world. Is there anything we can do? And are there any reasons to be optimistic?

First, we need to end the era of easy money. We need to stop subsidizing financial markets. We need to let banks and investors fail if they deserve to fail. We need to allow market forces to set prices, whether of financial assets or labor, and allow those prices to decline. We need to let our economy reorient itself from its short-term and transactional focus back to one based on long-term investment and long-term relationships.

We cannot continue to subsidize large corporations at the expense of smalls ones, just because large companies have the money to lobby. We must find a way to reduce pensions at the state and local level. We must return healthcare to a market system and recognize that one way or another healthcare consumption must shrink. We need to limit the power of the federal government, return power to local governments and reduce regulations that favor monopoly.

We must not turn our backs on global trade, but recognize, and acknowledge two truths. Yes, trade will always have negative effects on a small portion of the population (while having less obvious, but more significant positive effects on a larger portion of the population). And yes, there has been an excess of outsourcing, offshoring and foreign trade over recent years. But this is due to the prevalence of easy money and crony capitalism, not because of free market forces.

Similarly, we must recognize that while entrepreneurship is fundamental to a strong functioning and growing economy, the vast majority of recent entrepreneurship, specifically from the technology sector, has been wasteful at best, and extraordinarily damaging at worst. Only an end to stimulative monetary policy will fix this.

Finally, we must encourage not discourage immigration. Immigration is morally correct, is good foreign policy and is economically beneficial. Immigrants must be viewed as assets, which they are, not liabilities. And given aging populations and poor economic growth, population growth through significant immigration is the only chance to delay the inevitable implosion of the welfare state for another generation.

Are any of these things realistic given today’s toxic, and corrupt political system? Not a chance. There is absolutely no realization whatsoever among the economics profession, the mainstream media or the political community of the disastrous consequences of “modern” central banking. Nor is there any reason to believe that those in power who have benefited so much from decades of easy money will change their viewpoint.

Similarly, there is no political will to accept the near-term pain required of weaning the economy off of monetary stimulus and letting the economy restructure as needed. There is no political will to cut pensions. No political will to view healthcare as a consumer good, not an entitlement. No political will to end crony capitalism, to end the power of special interests. In short, there is simply no incentive for politicians to favor a long-term outlook. And herein lies the paradox of democratic government: it works until it grows too big to work.

So what happens next? Perhaps the world stumbles on for a while. Populists continue to come to power. The rich stay rich, the powerful stay powerful and the poor stay poor. Trade suffers, immigrants are shunned. Economic growth is weak. Capitalism continues to be viewed as the problem, big government as the solution. Maybe another financial crises that we can inflate our way out of. Maybe another financial crises that we can’t. Sooner or later the music stops.

About 100 years ago, the world sleepwalked into World War 1. Today the world sleepwalks into the next global disaster. Regrettably, I see few reasons to be optimistic.